Why USDTRY short is attractive in the long run - Forex Trade Setup

- Jonathan Lou Reyes

- Jan 17, 2024

- 1 min read

Here's a good trade setup in forex: look for opportunities to go short on USDTRY. Why?Deutsche Bank analysts predict that Turkish lira bonds will go from being the worst performing local debt market in developing nations last 2023 to the best performing in 2024. However, the analysts say it is too early to be structurally bullish and that local bonds need to reprice before offering value from a structural perspective. They recommend buying the lira against the dollar when 10-year notes reach 35%. Currently, it is at 42.5%. Their central bank will need to cut rates by 7.5% before buying lira becomes attractive. We should also note that Turkey's inflation is still rising, hence it will need to calm down first before their central bank will consider lowering rates. It's likely that we may have an opportunity to enter the trade by mid 2024.

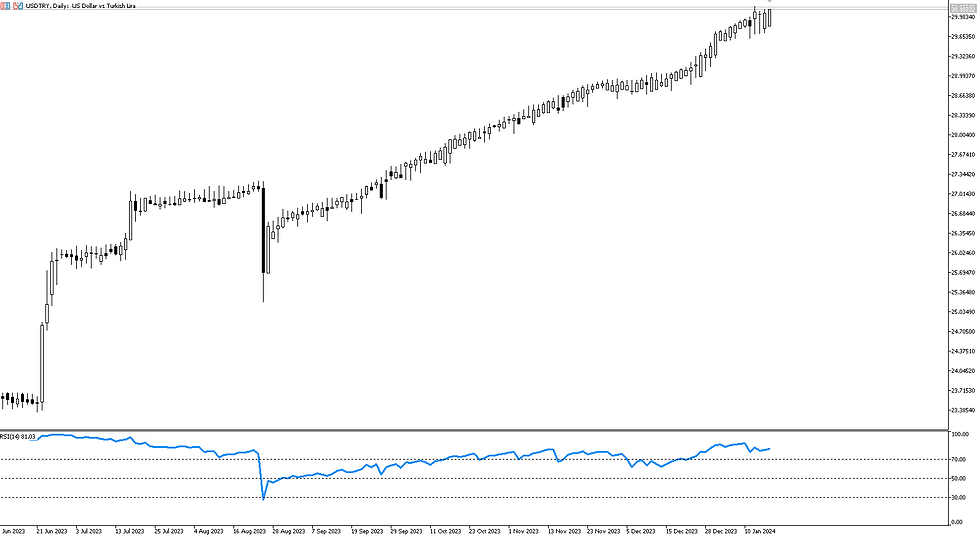

Here is the USDTRY chart. As of now, there isn't any sign of a good entry for short. In addition, technical analysis maybe a difficult in charts like these as there isn't much movement to base it on.

Looking at USDX, The US dollar has been trading inside a wide range for the past 2 years. The current momentum is also upward. This clearly shows that it isn't time to go short yet. However, once the US FED starts cutting rates (most predict by March 2024), then USD may start to go inline with our trade idea.

Comments